رد: Elliott Wave Analysis by EWF

Gold short term weakness likely

Gold to Silver Ratio Daily Elliott Wave Chart

Daily chart of Gold-to-Silver ratio above suggests that the ratio is correcting cycle from 2/29/2016 peak (83.68) before the decline resumes later, provided that pivot at 83.68 high stays intact. Short term, cycle from 7/4/2016 low (64.37) is showing a 5 swing incomplete sequence, favoring further upside in the short term. Expect the ratio to extend higher towards 76.55 – 78.68 area to end the rally from 7/4/2016 low, then it should at least pullback in 3 waves if not continue the next leg lower.

As the Ratio is inversely correlated with the underlying physical metals, this suggests that a higher ratio implies a lower XAUUSD and XAGUSD. Thus, we could expect short term weakness in both metals to persist until the Ratio reaches the target of 76.55 – 78.68, then when the Ratio turns lower, both metals can get support and start rallying also.

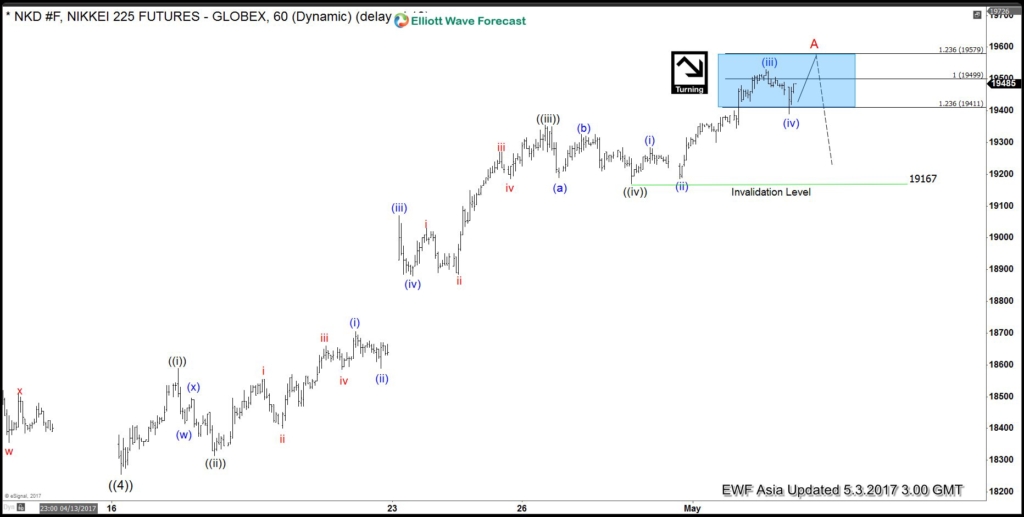

) ended at 18590, Minute wave ((ii)) ended at 18315, Minute wave ((iii)) ended at 19355, and Minute wave ((iv)) ended at 19170 low. Near term index has reached the minimum extension area in Minute wave ((v)) already, however another push higher towards 19579 area can be seen before index ends cycle from 4/17 lows in Minor wave A. Afterwards index is expected to see a pullback in 3, 7 or 11 swings within Minor wave B before further upside is seen. We don’t like selling the proposed pullback and expect buyers to appear again once Minor wave X pullback is complete in 3, 7, or 11 swing provided that pivot at 4/16 low (18255) remains intact.

) ended at 18590, Minute wave ((ii)) ended at 18315, Minute wave ((iii)) ended at 19355, and Minute wave ((iv)) ended at 19170 low. Near term index has reached the minimum extension area in Minute wave ((v)) already, however another push higher towards 19579 area can be seen before index ends cycle from 4/17 lows in Minor wave A. Afterwards index is expected to see a pullback in 3, 7 or 11 swings within Minor wave B before further upside is seen. We don’t like selling the proposed pullback and expect buyers to appear again once Minor wave X pullback is complete in 3, 7, or 11 swing provided that pivot at 4/16 low (18255) remains intact.

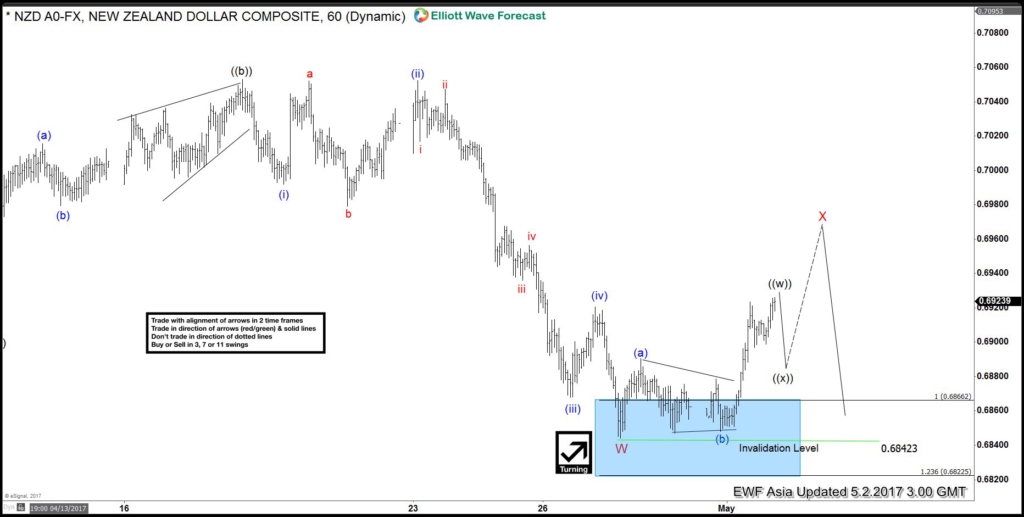

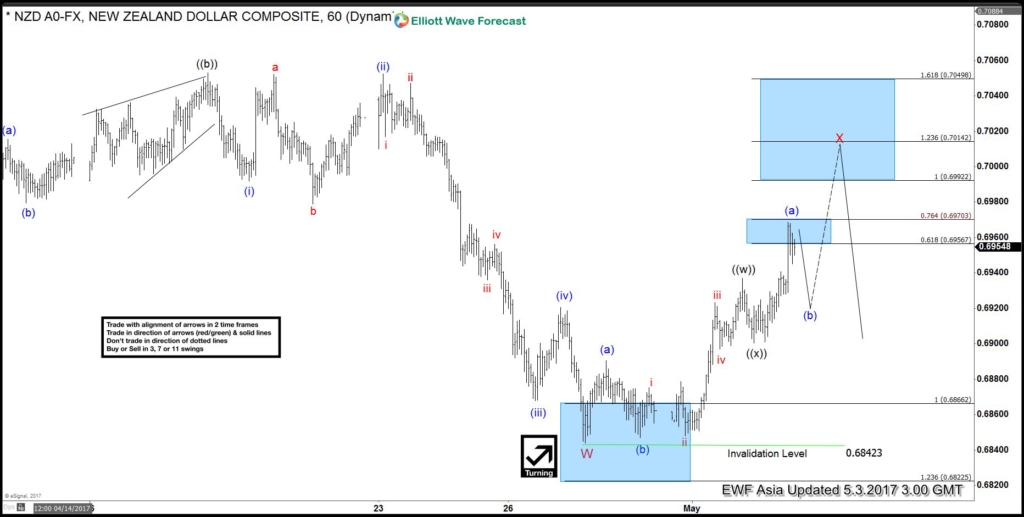

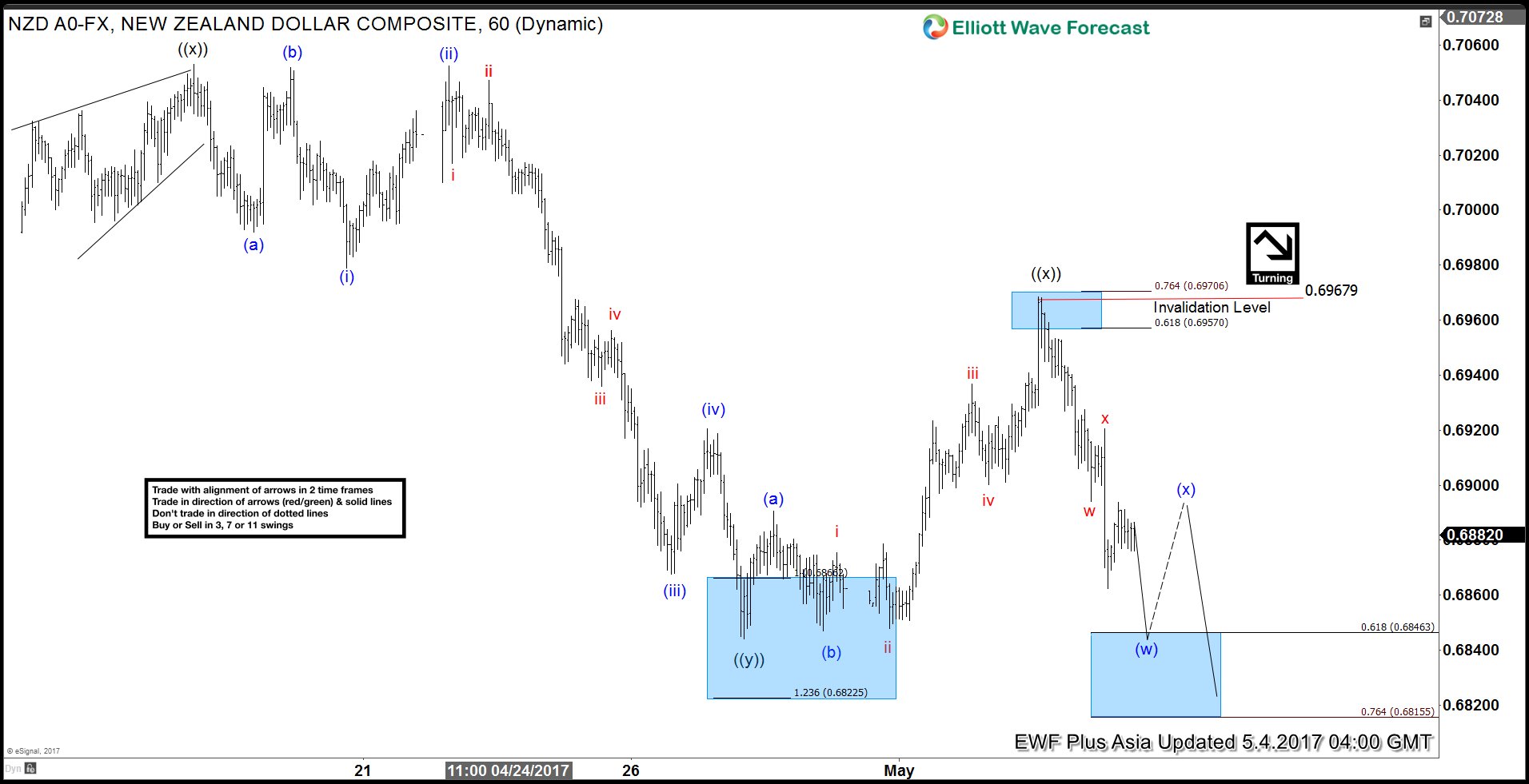

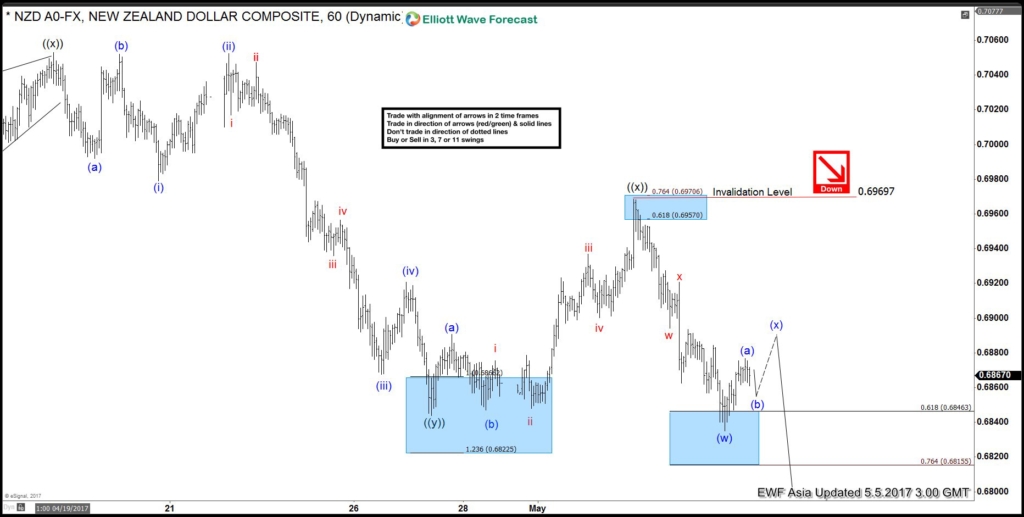

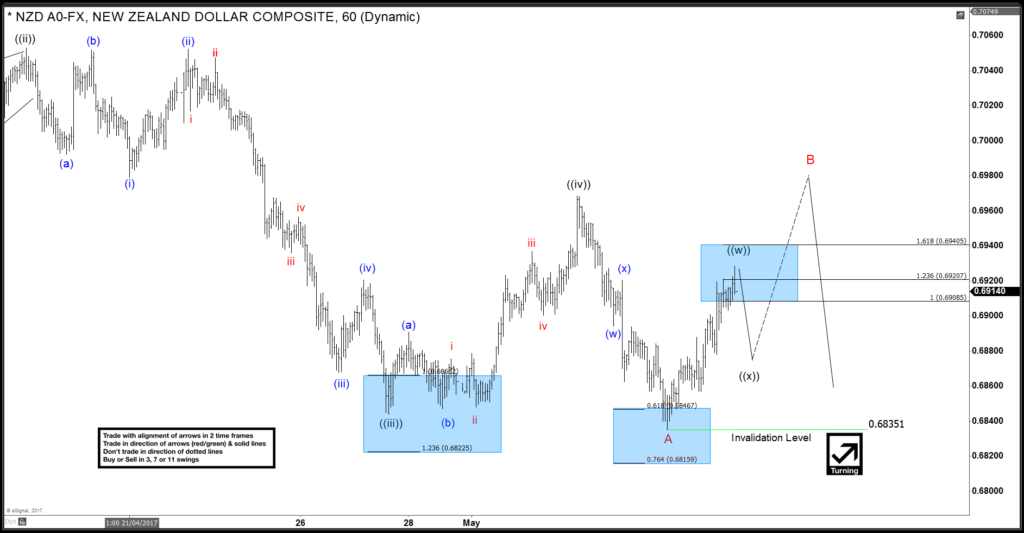

) ended at 0.6844 and Minute second wave ((x)) is proposed complete at 0.6968. Minute wave ((z)) is in progress and unfolding as a double three Elliott Wave structure where Minutte wave (w) is expected to complete at 0.6815 – 0.6846 area, then it should bounce in Minutte wave (x) to correct cycle from 5/2 high before pair resumes lower again. We don’t like buying the pair and expect bounces in Minutte wave (x) to find sellers in 3, 7, or 11 swing provided that pivot at 0.6968 high remains intact.

) ended at 0.6844 and Minute second wave ((x)) is proposed complete at 0.6968. Minute wave ((z)) is in progress and unfolding as a double three Elliott Wave structure where Minutte wave (w) is expected to complete at 0.6815 – 0.6846 area, then it should bounce in Minutte wave (x) to correct cycle from 5/2 high before pair resumes lower again. We don’t like buying the pair and expect bounces in Minutte wave (x) to find sellers in 3, 7, or 11 swing provided that pivot at 0.6968 high remains intact.

المواضيع المتشابهه

المواضيع المتشابهه