رد: Elliott Wave Analysis by EWF

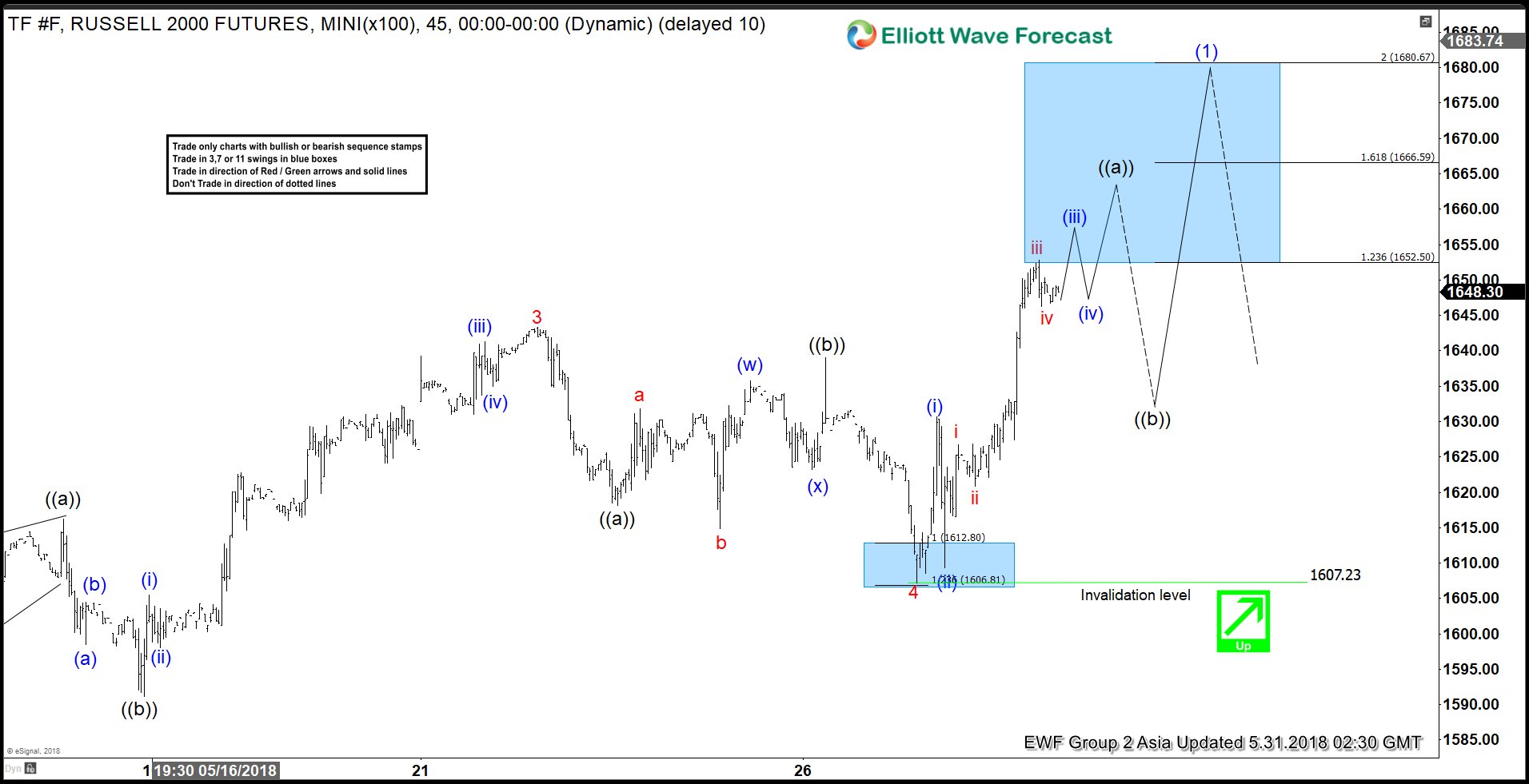

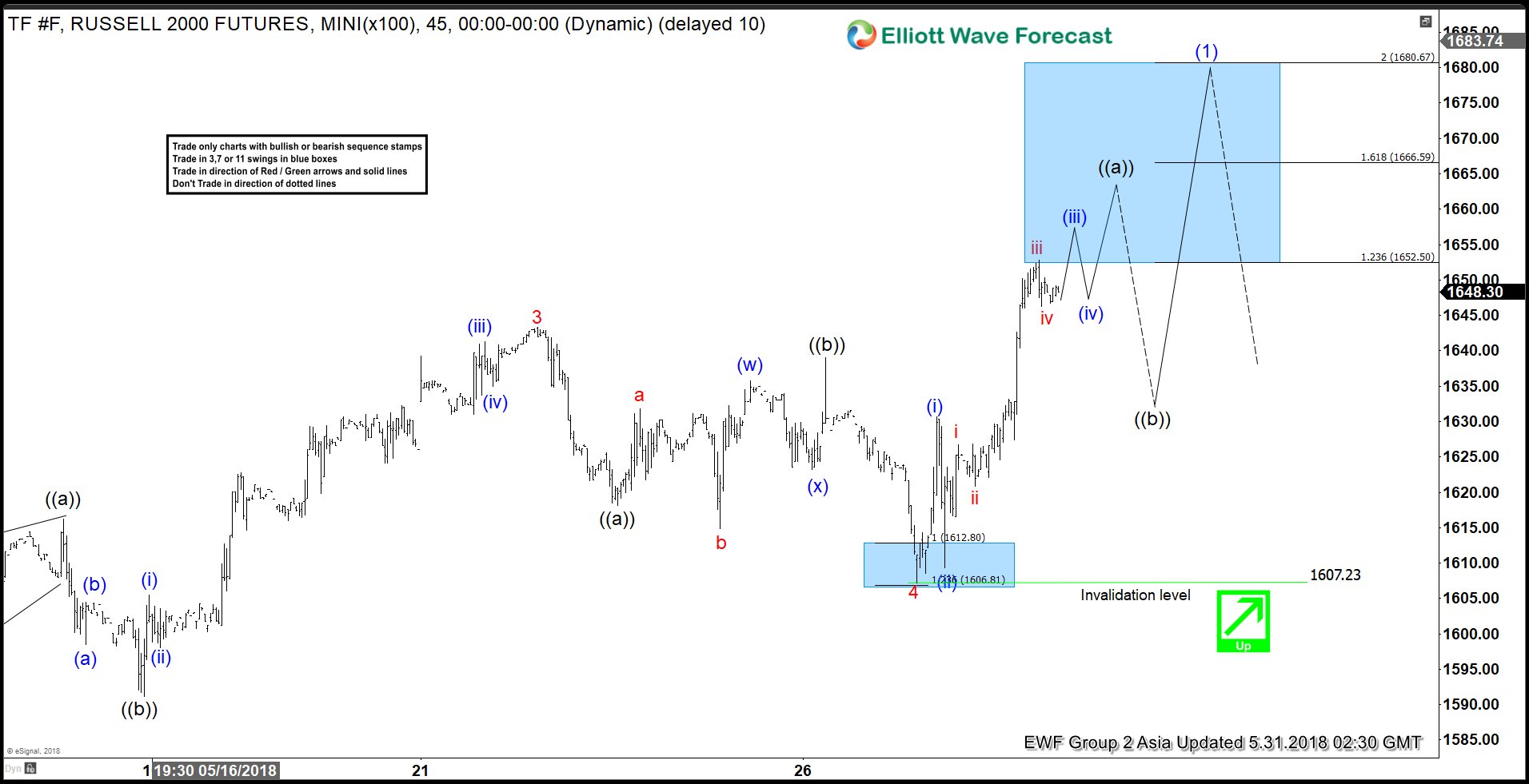

Elliott Wave View: Russell (TF_F) Pullback Around The Corner?

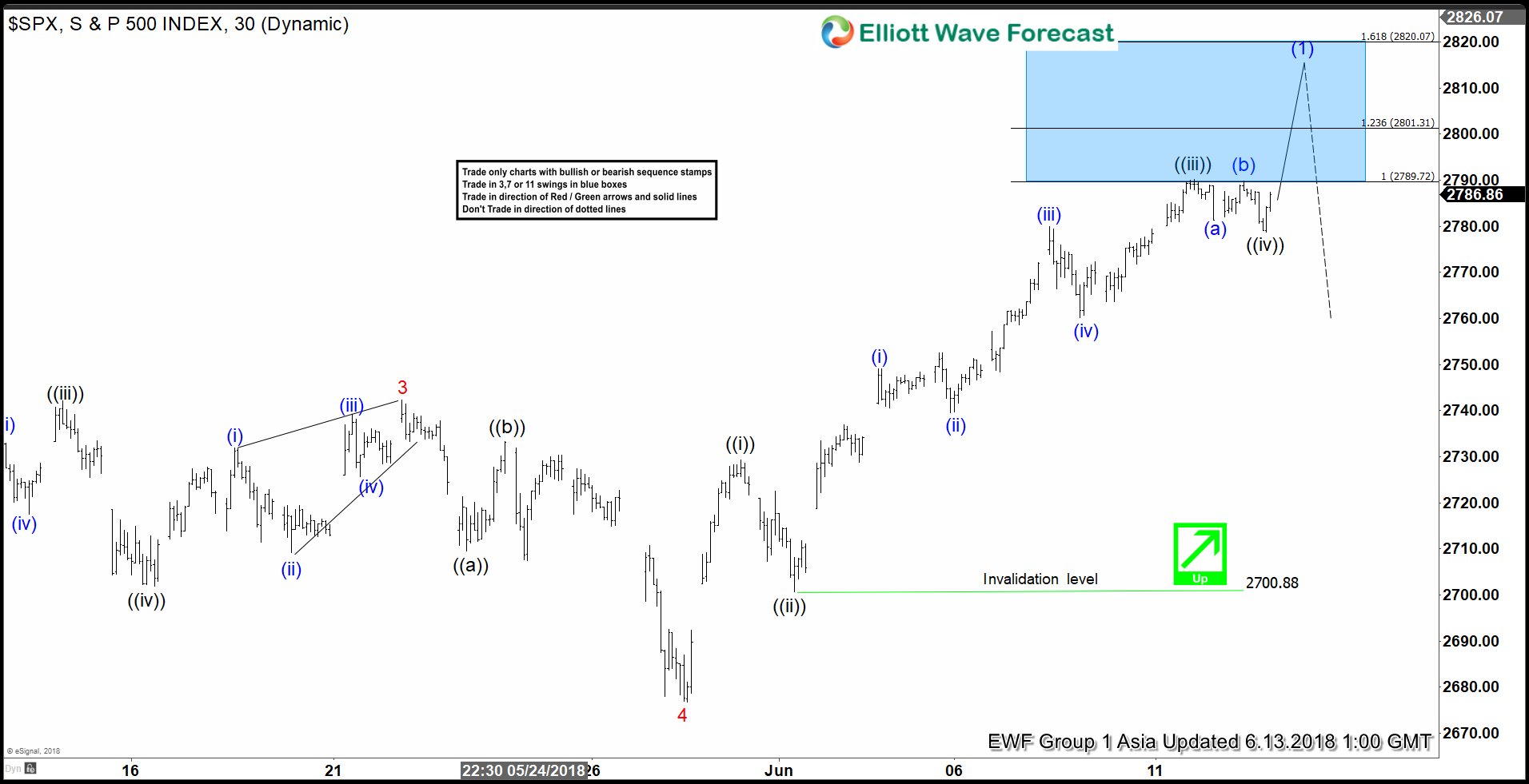

Russell (TF_F) index short-term Elliott Wave view suggests that the rally from April 02.2018 low (1482.6) is taking a form of an Elliott wave leading diagonal structure within Intermediate wave (1) higher. Leading diagonal structure usually appears as the sub-division of a wave (1) of an impulse or wave (A) of a Zigzag structure. The internal sub-division of a leading diagonal can either be 5,3,5,3,5 or 3,3,3,3,3.

In Russell’s case, the internal sub-division of Intermediate wave (1) is unfolding in 3.3.3.3.3. Minor wave 3 of (1) ended at 1643.3 as corrective 3 waves (zigzag) structure. Where Minute wave ((a)) of 3 ended at 1616.2. Minute wave ((b)) of 3 ended 1591.2. And Minute wave ((c)) of 3 ended at 1643.3. Down from there the pullback to 1607.23 low ended Minor wave 4 of (1) with internals also as a zigzag structure. When the Minute wave ((a)) of 4 ended at 1618.1 and Minute wave ((b)) of 4 ended at 1639.

Above from 1607.23 low the index has already made a new high confirming Minor wave 5 of (1) has resumed. The rally is expected to take the form of another zigzag structure. As far as near-term dips remain above 1607.23 level, the index has scope to extend higher towards 1680.67 area before ending Intermediate wave (1). Afterwards, the index is expected to do a pullback in intermediate wave (2) in 3, 7 or 11 swings before further upside is seen. We don’t like chasing it here because it has already reached the minimum extension area for Minor wave 5. I.e it has reached inverse 1.236-1.618% Fibonacci extension area of 4 at 1652.50-1666.59 area.

Russell 1 Hour Elliott Wave Chart

المواضيع المتشابهه

المواضيع المتشابهه