رد: Elliott Wave Analysis by EWF

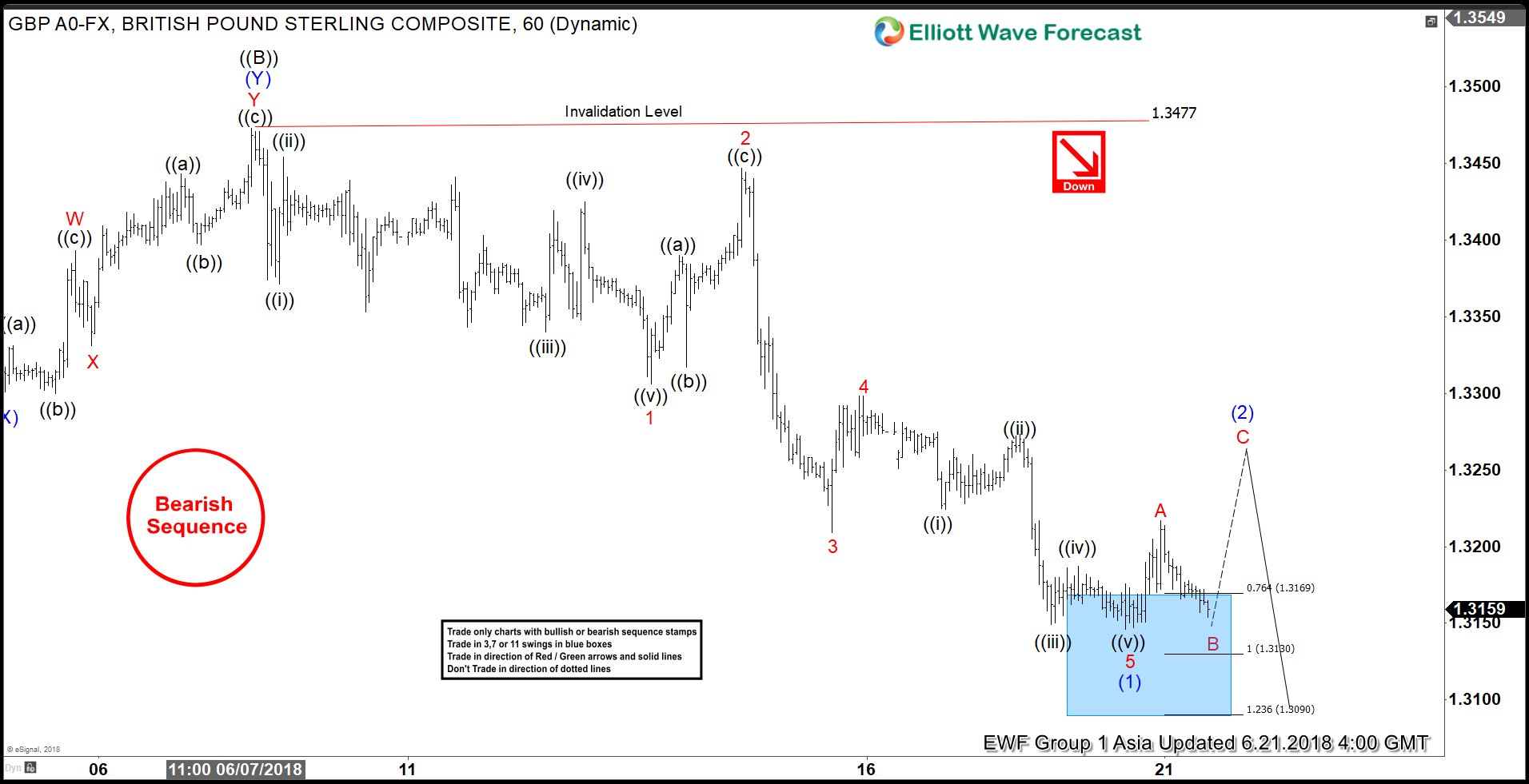

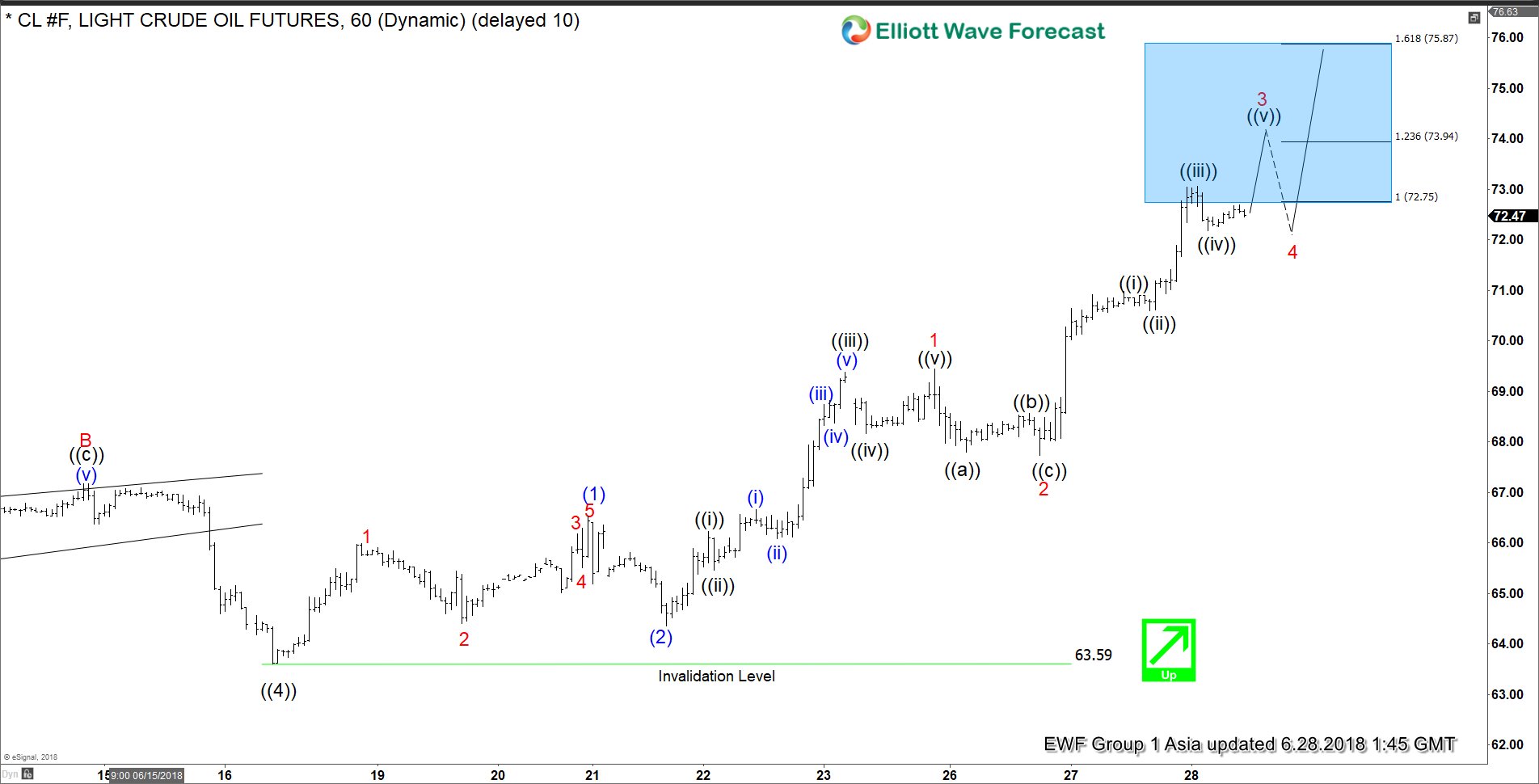

Facebook (FB) Elliott Wave Analysis: Pullback Remains In-progress

Facebook ticker symbol: $FB short-term Elliott wave analysis suggests that the rally to $203.55 ended primary wave ((1)). Down from there, the pullback in primary wave ((2)) remains in progress in 3, 7 or 11 swings to correct cycle from 3/26/2018 low. The internals of that pullback shows an overlapping structure thus suggesting that the correction takes the form of corrective structure i.e either (W),(X),(Y) or (W),(X),(Y),(X),(Z) structure within the intermediate degree.

Below from $203.55 high, the pullback is proposed to be unfolding as Elliott wave double three structure where Intermediate wave (W) ended at 193.11, Intermediate wave (X) ended at 200.75, and Intermediate wave (Y) of ((2)) remains in progress. The internal of Intermediate wave (W) also unfolded as a double three structure where Minor wave W ended in 3 swings at $199.31, Minor wave X ended $202.24 and Minor wave Y of (W) ended at $193.11 as a Flat. Up from there, intermediate wave (X) also unfolded in 3 swings as Elliott Zigzag structure with Minor wave A ended at $199.40, Minor wave B ended at $195.98 and Minor wave C of (X) ended at $200.83 high.

Down from there, intermediate wave (Y) of ((2)) remains in progress as another double three structure. Internals of that decline ended Minor wave W in 3 swings at $192.22 and Minor wave X ended at $197.45. Near-term focus remains towards $188.91-$186.90, which is 100%-123.6% Fibonacci extension area of Intermediate wave (W)-(X) to end primary wave ((2)) pullback. Afterwards, the stock is expected to find buyers for primary wave ((3)) higher ideally or should do a 3 waves reaction higher at least. We don’t like selling it into a proposed pullback.

Facebook ($FB) 1 Hour Elliott Wave Chart

المواضيع المتشابهه

المواضيع المتشابهه